-

Casinos for you

Cryptocurrencies 2021 Survey: Save or Spend?

By GamblersPick Aug 11, 2021 Investing in Cryptocurrencies 2021 Survey. How much cryptocurrency is being held on average? How do people purchase their crypto? Why investors keep holding cryptocurrencies and are there any future actions planned to buy more crypto assets and coins?

Investing in Cryptocurrencies 2021 Survey. How much cryptocurrency is being held on average? How do people purchase their crypto? Why investors keep holding cryptocurrencies and are there any future actions planned to buy more crypto assets and coins?Exploring How Investors Are Managing cryptocurrencies in Today's World [Survey]

To save or to spend crypto? That is very much the question for many investors today. As they invest more, they are often forgoing other purchases – some of them essential. Many have even started to accumulate debt in order to buy more crypto or avoid selling it. In order to get to the bottom of what the cryptocurrency craze is really costing Americans, we spoke to 1,000 people on the topic.

Crypto investors shared the amount they had, how they were financing the holding, and what they had given up in order to maintain the investment. Responses showed interesting differences across genders and generations. To see how different demographics and Americans as a whole are maintaining their crypto portfolios, keep reading.

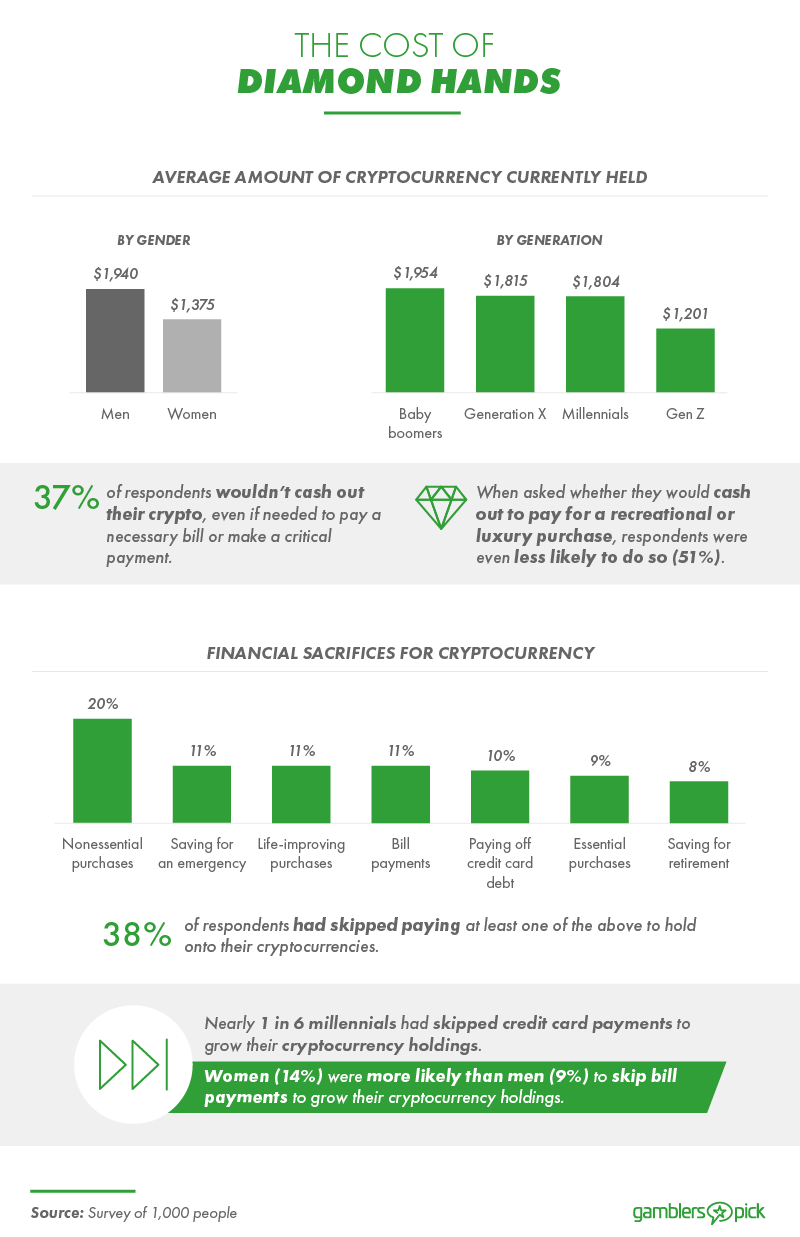

Trade-Offs for Holding On to Cryptocurrency

The total cost of cryptocurrency is more than just a dollar amount. It also includes the cost of the things you can't afford to buy if you choose to keep your money invested. The first part of this study looks at how much cryptocurrency respondents are holding, on average, as well as the top things they're choosing to forgo paying for in order to hold on to that investment.

Diamond hands are as expensive as they sound. On average, Americans reported currently holding $1,707 of cryptocurrency each but often admitted that they wouldn't touch that money even if a necessary bill or critical payment came up. More than 1 in 10 stopped saving for an emergency to buy crypto, while the same amount said they had skipped out on a purchase that would have genuinely improved their life.

Millennials were the most likely to skip saving for their retirement or miss credit card payments to hold onto their existing crypto stashes. That said, the majority of credit card debt is currently held by Generation X, so perhaps millennials have slightly more wiggle room here. Baby boomers, though unlikely to take on debt for cryptocurrency, also had the highest average value already saved up.

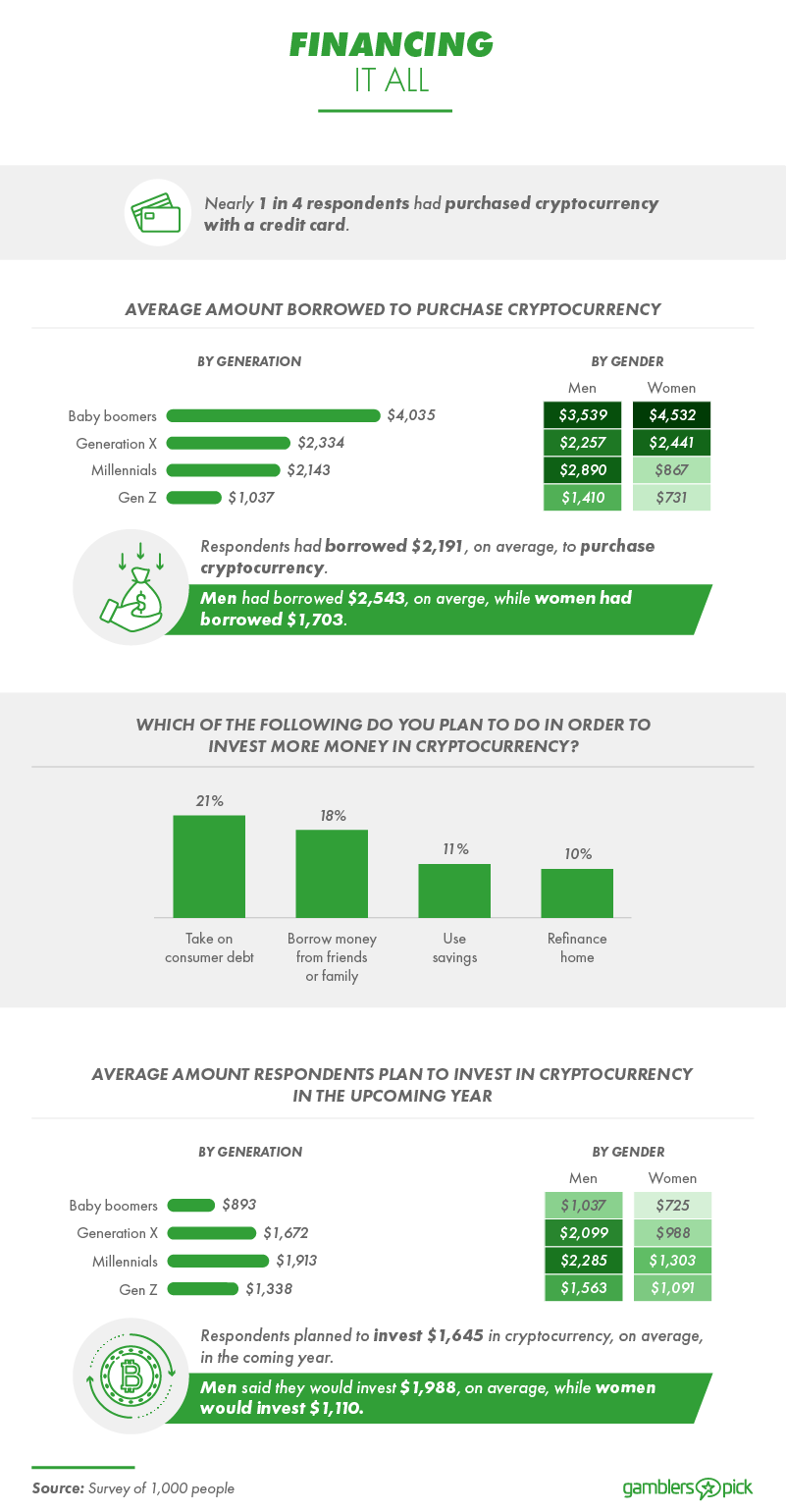

Affording More Cryptocurrency

So how exactly did Americans come to own their roughly $1,700 worth of cryptocurrency? The next part of our study asked respondents how they purchased their crypto, how much they had to borrow, and what they plan on doing in the future to perhaps buy more.

Cryptocurrency may well be one of the reasons that many Americans have credit card debt in the first place: 1 in 4 respondents said they purchased cryptocurrency with credit instead of cash. And, in spite of holding only $1,707 worth of crypto, respondents had borrowed nearly $500 more than that to afford it, whether from the bank or from friends and family. Twenty-one percent of respondents planned on accumulating consumer debt in the future to afford more cryptocurrency.

The investment gender gap also appears to continue over from traditional investments into cryptocurrency. Men were planning to invest an average of $1,988 into cryptocurrency this upcoming year – $878 more than women. Men were also more likely to borrow in order to add more crypto to their personal rosters. However, while men were more likely to borrow in general, generational breakdowns show that Gen Xer and Baby boomer women had borrowed more on average than men of the same age.

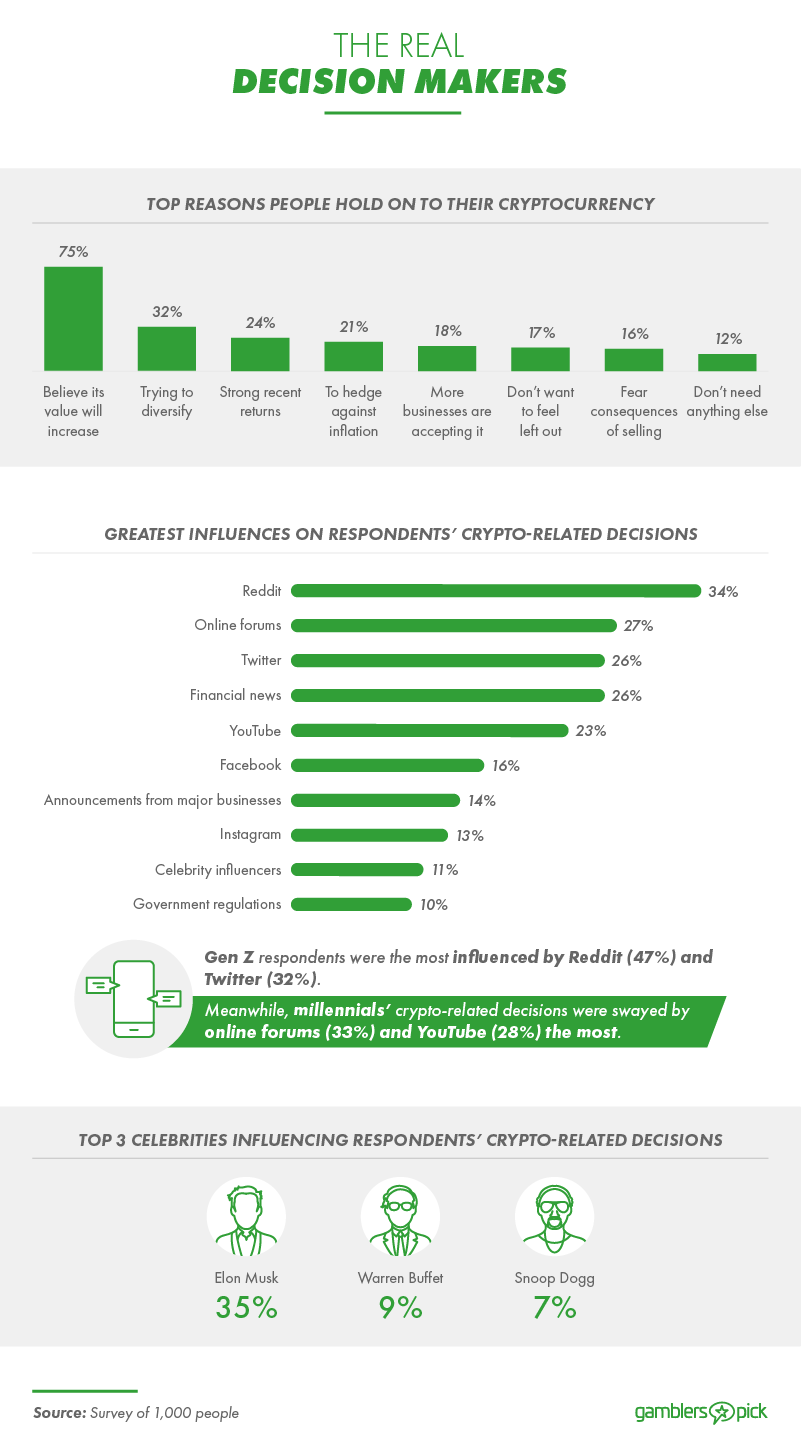

Reasons for Holding

Respondents had clearly made some drastic financial decisions in order to stay involved with digital currencies. This part of our study asks about their reasons for doing so and the sources they were most commonly influenced by.

People taking on debt or avoiding critical purchases may ultimately have the last laugh: Three-quarters of people holding on to cryptocurrency said they believed it has much more value to gain. About a third of respondents said they held on to their cryptocurrency simply to maintain a diverse portfolio.

Decisions on how and when to invest were made mostly after consulting Reddit, with over a third of crypto holders getting their information there. While not all information on the site is verified, the world has recently seen the power that Reddit can have over the financial industry. The only source more influential was a single individual – Elon Musk –whose tweets have been known to impact Bitcoin greatly. In one instance, a tweet from Musk plummeted the price of Bitcoin to below $30,000 – a low for this fluctuating currency.

Planning Ahead

Looking forward, respondents had already laid out some cryptocurrency-related plans. Our study concludes with a look at their anticipated future actions and what they feel willing to sell in order to buy even more digital currency.

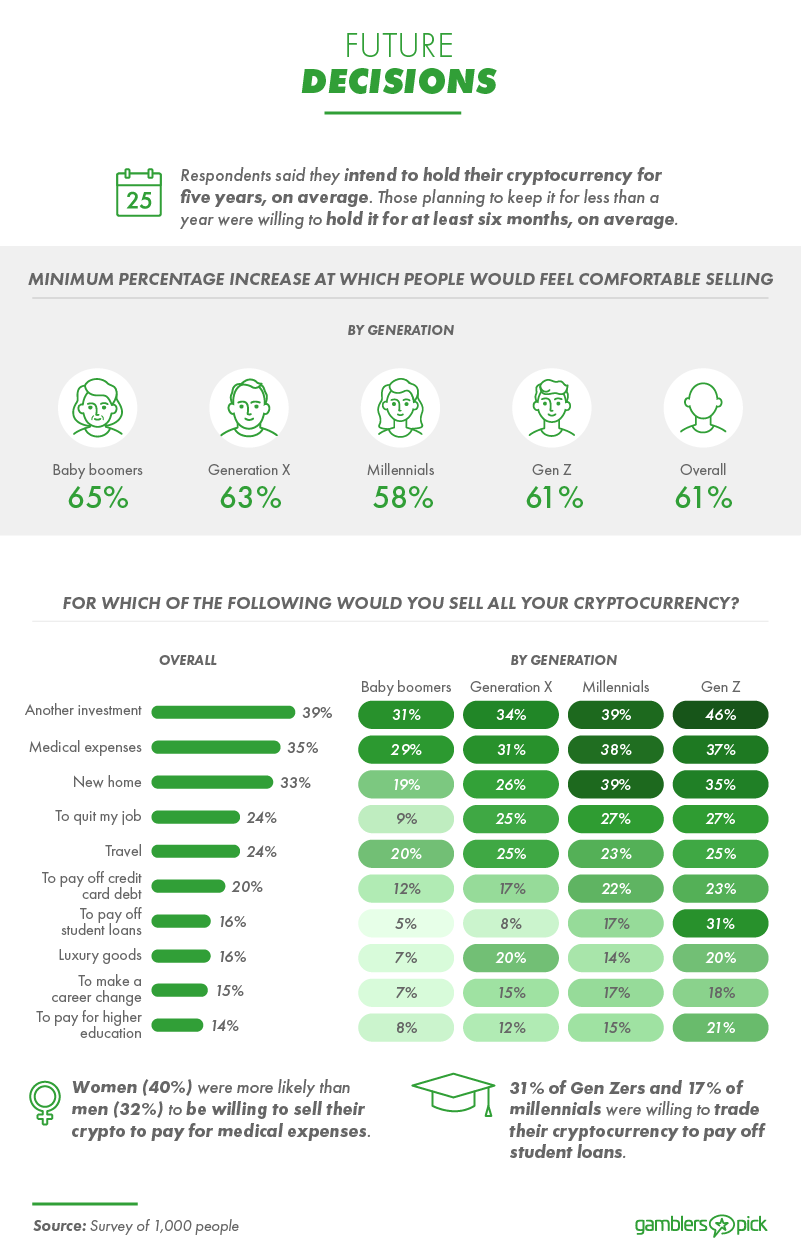

On average, respondents planned on maintaining their crypto balances for another five years. That said, enormous increases in price would certainly sway a few to start selling. Overall, respondents agreed that a 61% price increase in bitcoin could cause them to sell. Baby boomers, however, had the highest threshold for selling: This generation wanted a 65% increase before they sold.

Respondents were highly unwilling to sell all of their crypto, even in exchange for some pretty valuable things. Only a third said they would sell all of their crypto in exchange for a new home. Considering that the average house price in the U.S. is roughly $287,000, and the respondents we spoke to had fewer than $2,000 worth of crypto, this speaks to an incredibly high anticipated rate of return. Gen Z, however, had many respondents agreeing that they would get rid of all of their cryptocurrency if it would cover their student loan debt.

Cryptocurrency Costs

Respondents proved that there are more costs involved in investing in cryptocurrency than just the dollar amount. They were often investing in lieu of life-improving purchases, paying down credit card bills, or even covering medical expenses. Men and baby boomers were the most likely to borrow in order to continue financing crypto.

In the future, most anticipated doubling down on aggressive decisions like these. Few would sell everything even for a new home or being able to quit their jobs. Of course, they felt their decisions were the right ones, as three-fourths said their primary motivation was an anticipation of a solid return on investment. For most, a 61% price increase would cause them to sell what they had. For others, diamond hands were the most valuable asset of all.

Methodology and Limitations

We surveyed 1,000 crypto investors on their behavior while investing. Among them, 60% were men, 39% were women, and 1% identified as nonbinary. For generational breakdowns, the sample sizes were:

- Baby boomers: 135

- Generation X: 212

- Millennials: 442

- Generation Z: 206

- Other: 5

For short, open-ended questions, outliers were removed. To help ensure that all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question.

These data rely on self-reporting by the respondents and are only exploratory. Issues with self-reported responses include, but aren't limited to, the following: exaggeration, selective memory, telescoping, attribution, and bias. All values are based on estimation.

Fair Use Statement

As the cryptocurrency conversation grows in pace and fervor, data-based information becomes more important than ever. If you or your followers would be interested in this type of information, you are welcome to share it. Just be sure your purposes are noncommercial and that you link back to this page.

Tags

Related Blog Posts

-

CASINOS

- Popular

- Specialty

- Features

- Casinos By

-

BONUSES

- Popular

- By Type

-

GAMES

-

Slots

- Popular

- By Software

- Variations

- Features

-

Blackjack

- Popular

- Variations

- Features

-

Roulette

- Popular

- Variations

- Features

-

Video Poker

- Popular

- Variations

- Features

-

Craps

- Popular

- Features

-

Baccarat

- Popular

- Features

-

Poker

- Popular

- Variation

- Features

-

More Games

- Keno

- Bingo

- Fixed Odds

- Other Games

-

JACKPOTS

- Popular

- By Game

- By Software

-

COMMUNITY

.png.0f651d9e8ab97819d8e6bcc89d162b26.png)

.png.a0acfd195007976e042ec7e6bcc699bc.png)

.jpg.0f083fed53833a901d7e4f85850a3502.jpg)

.jpg.80608d000033788c9aa397d7b5489349.jpg)

.jpg.6b9828f10acec861aa6d7ecd9550803e.jpg)

.jpg.6b9828f10acec861aa6d7ecd9550803e.jpg)

![Gauging Investors’ Stock Market Knowledge [Survey]](/uploads/monthly_2021_09/stock-market-smarts-header.jpg.ed9e6b59e99212d460da620a6bcb5d24.jpg)

Recommended Comments

There are no comments to display.

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.

Write a comment